Frequently accounting professionals will ask questions like: What should I be charging for my services? What is the average billing rate for bookkeepers? Certified QuickBooks ProAdvisors? Accountants? Certified Public Accountants (CPAs)? Enrolled Agents (EAs)? Tax Professionals? Should I charge an hourly rate or fixed fees? Unfortunately, the answer is usually — it depends. There is no ‘one size fits all’ when it comes to billing rates for accounting professionals. It depends on your education, experience, expertise, geographic location and more. The good news is that there is information available to help you get an idea of average billing rates to help you determine and set your billing rates and policies.

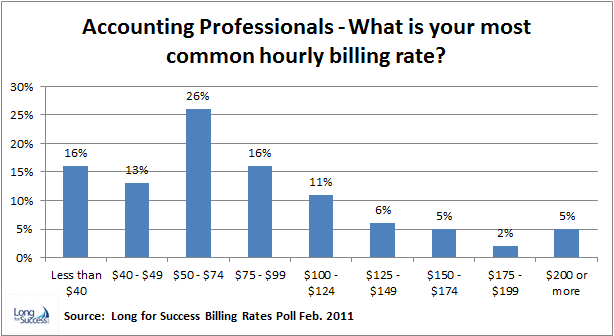

I put a quick poll on my website asking accounting professionals for their most common billing rates. Here are the results based on almost 1,000 replies:

For more detailed information on average billing rates for accounting professionals, check out these resources:

- Intuit’s Average Billing Rates Survey

- National Society of Accountants Survey of Average Tax Preparation Fees

Remember billing rates should be established based on a number of criteria and considerations. Keep in mind the value of your education, experience, skills and more. Please do not set your billing rates too low. It may be tempting when you are new to the profession or just starting your business or whatever, but it devalues your services and does not help you get quality clients.

Pingback: Accountant Billing Rates | Rates for CPA Services for SMB

Steve (or whoever you really are)

Your personal attacks are unprofessional and uncalled for. I will let my resume speak for my credentials as a 20+ year CPA http://www.jonathangorman.com.

Second, there is no Steve McDirth CPA licensed in Texas. What else are you making up? Use your real name and credentials before you put down others.

And if you really owned a Texas CPA firm holding out unlicensed individuals as Accountants, you would be in violation of Texas Code, section 901.005:

The terms “accountant” and “auditor,” and derivations, combinations, and abbreviations of those terms, have an implication of competence in the profession of public accountancy on which the public relies in personal, business, and public activities and enterprises.

The policy of this state and the purpose of this chapter are to provide that:

(1) the admission of persons to the practice of public accountancy require education and experience commensurate with the requirements of the profession;

(2) a person who represents that the person practices public accountancy be qualified to do so;

(3) a person licensed as a certified public accountant:

(A) maintain high standards of professional competence, integrity, and learning; and

(B) demonstrate competence and integrity in all dealings with the public that rely on or imply the special skills of a certified public accountant and not merely in connection with the performance of the attest service;

Jonathan,

She isn’t being misleading. She clearly said its a mix of professions all related to accounting that are making up that amount. You have an issue because she said Accounting Professionals in her title? If that’s an issue for you, then you yourself aren’t a true professional!

To say people in Texas aren’t allowed to call themselves Accountants is quite immature. It is one of the highest growing professions in this state and the most sought after degree!

I own a CPA firm and have several ACCOUNTANTS who aren’t CPA’s working for me who are probably a lot more qualified than you in accounting. We know by getting licensed that we are under stricter rules but that doesn’t discount accounting professionals who don’t need to obtain a CPA to advance their careers.

Know your facts and be appreciative for everyone in the field and what they’ve accomplished. Don’t take very valuable information for some people and criticize it. Your exactly what’s wrong with this country and why we sometimes get a bad rep in this profession.

That is all and god bless.

Steve M, CPA

Michele,

I wonder if you are being a bit misleading then when you use the word Accounting Professional. It confuses people between licensed CPAs and people who are unlicensed, and in many states are not allowed to hold themselves out as accounting experts (or use the word Accountant in Texas unless licensed).

Accounting is so much more than bookkeeping or tax professionals, and the use of the phrase is getting out of hand for non-licensed people that profess to have an expertise in a field that requires licensure.

As a fellow Pro-Advisor, I have much respect for people who are not CPAs and help people set-up their businesses, but by the same token, many of them don’t understand GAAP requirements for certain businesses.

As a CPA we can lose our license to practice for trying to do something we aren’t capable of doing – non-CPAs don’t have that issue and therefore I don’t like seeing them advertised as accountants in public (unless licensed).

Remember this is an average — not all CPAs do attest services when they start working with small business and QuickBooks consulting. When I started my own practice, I never did audits or reviews. Plus, I quit doing compilations because the related requirements were a pain. 🙂

Michelle,

I don’t think that this chart is representative of anything. A CPA doing attest services isn’t even going to touch a client for less than $175-225 per hour. A complicated tax filing may be at a little less.

Helpful Michelle, thank you!

Brannon– good points!

Mark — thanks for recommending my book! I appreciate it. I’m updating Successful QuickBooks Consulting and hope to have it available soon. A lot has changed over the past few years! As for the poll results, you’re right. My web site visitors who answered the quick poll, include more QuickBooks ProAdvisors, bookkeepers, etc. vs. CPAs (which higher billing rates). Thanks for reading & commenting! 🙂

Michelle,

What an odd looking distribution. I would’ve expected a more uniform curve. This tells me more about your visitors than what we could bill in my opinion. I think there’s a human element where people don’t value themselves correctly. When people are starting out, they feel like they aren’t worth what they charge.

The thing is, they are worth every penny.

Thanks,

Mark

P.S. I got your book. It is really helpful and I’m definitely recommending it on my website.

Great information! Fixed fees are the only way to go in my opinion. Clients like it better. My expereince is that accountants generally are able to bill more than they think they can. Clients are service sensitive! If the service is great and you are adding value, clients will appreciate that and be willing to pay higher fees.

I agree that fixed fees are a good idea and can help improve your profitability (especially for those clients who think the hourly rate is too high). The Intuit Average Billing Rates survey (there’s a link the post), has some stats / info on fixed fee vs. hourly billing.

Great article Michelle and good points around devaluing services and attracting quality clients. What are your thoughts around agreed (or fixed) fees? With a large portion of the profession moving to the cloud (facilitating a more frequent relationship with clients), we’re seeing a number of firms move to a monthly fee. The shift to monthly billing is also allowing these firms to bundle a number of services and offer them as a package – resulting in a larger uptake of higher value services like quarterly management reporting. Have you got any stats around the use or adoption of agreed fees in the US?