Job costing is important to contractors, builders and many other types of small businesses such as plumbers, electricians, architects, landscapers, wedding planners, caterers and many others. When the business is a sole proprietor (or an LLC taxed as a sole proprietor), then the owner takes an Owner’s Draw instead of a paycheck. Thus, you cannot allocate the owner’s time to jobs via payroll. Instead, you can create a zero-dollar check to allocate the owner’s time (i.e. cost) to the job as follows:

- Create an expense account called Owner’s Job Cost Allocation (this account should zero out so there is no impact on the Profit and Loss).

- Create a two-sided service item (by checking the box that says this service is performed by a subcontractor or partner) for the owner’s time which is mapped to the Job Cost Allocation expense account created in step 1.

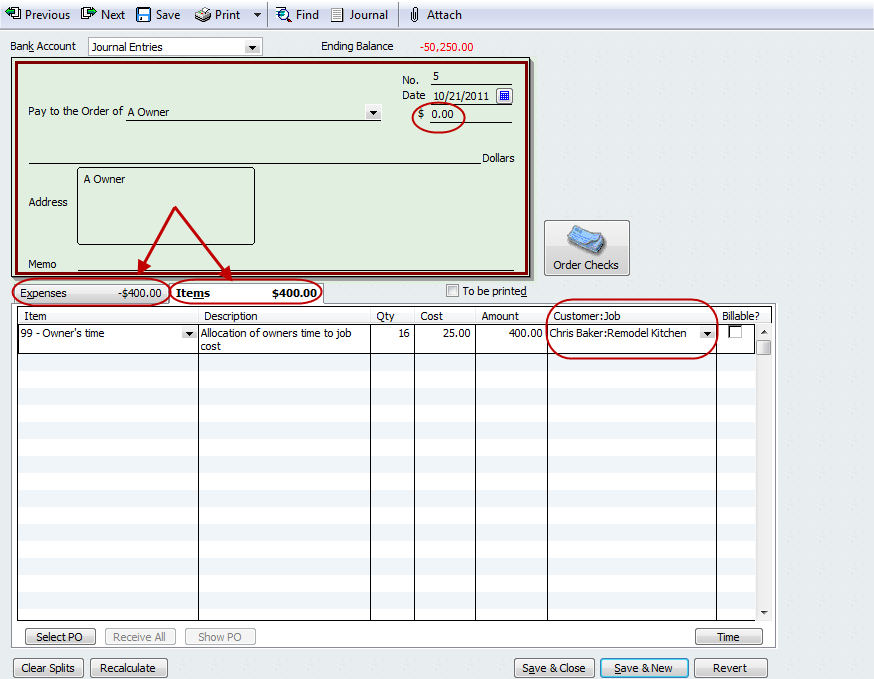

- Enter a Zero Dollar Check to the owner

- On the items tab, allocate the owner’s time to the jobs as appropriate using the item(s) created in Step 2 and the customer:job.

- On the expenses tab, enter a negative amount for the total to the Job Cost Allocation account.

The job profitability reports will include the expense but there is no impact on the Profit & Loss report (the job cost allocation expense account zeroes out). Voila — quick and easy to get the reporting information needed to monitor job profitability.

Michelle, can you document this option and post and update or alternate process?

Yes you can set up and use an account specifically for these entries.

Good workaround. The only issue that results from this method is you will eventually have a zillion check transactions created under the owner’s account. From what I have surmised, it is probably best to create a separate vendor account (the owner) solely for these transactions, because if you do them directly in the owner’s account that is being used for draws it would dirty up the check transaction history / report.

Thank you! I have searched all day for this!

As a sole proprietor, your time is not deductible for tax purposes. However, you should consider your time when pricing the items you sell. You could use the method described in this article to allocate your cost to inventory items (instead of an expense account).

For purposes of valuing and reporting inventory, I have finished goods on hand that has no wage/direct cost assigned to it since I am the sole proprietor and collect no salary or wage. How will I account for the value of the production time if there is no wage expense associated with its manufacture?

It isn’t too uncommon for direct labor to be shown as a Cost of Services. Discuss it with the partners and the accountant/ tax professional.

I have a question about Guaranteed Payments to partners in an LLC. They get paid based on the labor they perform (they do private lessons). They want to make this a COGS account. What is your opinion about this?

I haven’t tried it myself. I’d suggest you try it out in a sample company to see if it might work for you.

Michelle, is there a way to set up an inventory assembly and use this concept of including the owner’s time it takes to build the assembly?

Will do! Thank you and Merry Christmas.

Emily

It depends on the type of entity — if it is a sole proprietor (or LLC taxed as a sole proprietor) then the owner’s time isn’t a deductible business expense (i.e. no impact on net income as explained in the blog post). Talk with your accountant or tax professional for advice based on your situation.

I enter the customer as the payee and Job Related Labor Costs as the Account. Then it shows on the job and flows down to the net income. I feel this more accurately shows the income by factoring in my husband’s time. Can this be done?

Equity accounts don’t show on the job profitability reports. However, you should be able to modify the reports to include the equity account.

Michelle,

I have an Equity Account called Owner’s time to jobs that enables me the same traceability by job. Why would I not use this to track my husband’s hours spend on a job?

Emily

In the preferences & employee info, you need to indicate you want to use time data to create paychecks. Since you have Assisted Payroll, ask them and they can help you.

I actually tried that as well. I created a paycheck for 1 day for 8 hours on a project to test it. For some reason it is still showing $0.00 costs to job. The 3999 is an Equity account. Does that have anything to do with it? I’m also using QB 2011 and Assisted Payroll.

The problem is you’re not creating a paycheck for the owner (which allocates the cost to the job). That’s why you use this workaround to allocate the costs to the job.

Michelle,

I’m trying to figure out how to do this but I’m having some trouble. I have a couple of QuickBooks books that say to set up a 3999 – Owner’s Time to Job, which I have done. But when I right a check for time on my timesheet I get $0.00 costs to the job. I can’t seem to figure out what I’m doing wrong.

Michelle –

On the two-sided service item, do I need to have a owner’s income account too?

Thank you,

Shannon

Thanks for your patience Michelle; I had not completed one of my transactions so had left a balance in the equity account ‘Owner’s Time Allocation’ -I completed the transaction and there is no longer a balance there -now I understand your answers….

The accounts are an expense account so they start over each year anyway. No need for a clearing account or any entries.

Thanks for the clarification; so if I want to clear this account annually, I would just use a clearing account.

@Anik — there isn’t a real impact on an equity account or the profit & Loss. This is just an allocation for reporting purposes to see the cost on the job cost reports. Owners / Sole proprietors do not get to deduct their time as an expense.

QUESTION:

Michelle,

First, thanks for the tip; I am using it for my husband’s business to get a clearer idea of actual profit -I never did like the idea that I could’t keep track of how much time he spent on a job -as a bookkeeper that is always my first concern.

When applying this to a Sole Proprietor business, would we want to clear (at year end) this time allocation account thru the owner draw/owner equity account?

Or would I create a different equity account to keep track of this owner contribution?

Thanks again for all the valuable information you make available to all of us!

Anik

Make sure you indicate the customer:job name with the amount on the items tab and not on the expenses tab (otherwise it zeros itself out). Also, double check the dates of the check with the dates of the report.

I allocated owners time for job costing writing a zero check and I also created a two sided service item. When I go to my reports, the owners hours are not listed on my job detail reports. Am I missing a step?

On my two sided service item I also wasn’t sure which income account to put.

I created an expense account called Owner’s Job Cost Allocation and followed the steps above for applying owners time for job costing but when I go to my reports- time by job summary and time by job detail, it doesn’t show the owner’s job cost time allocation. We have a 5 member LLC and I grouped their hours by job and wrote a $0.00 check. Can you help?

This blog post shows how to allocate owner’s time for a sole proprietor (they are not employees and thus not paid via Payroll). When you process the paychecks for the project manager and owner, you can indicate the customer:job and QuickBooks will allocate the labor to the job.

If I want to allocate project manger’s and owner’s salaries from admin accounts to job costs accounts/jobs should I do this or just do a month end journal entry? What are pros and cons of each. Thanks

very nice Michelle! Technically, I think it would be An Owner. 🙂

Great information!

Great information. Thanks!

If they are taxed as a corporation, they should be on payroll. I asked my tax guru friend Kenneth and here’s his response:

If an LLC makes an election to be treated as a regular C corporation, the LLC’s profits are not subject to self-employment tax. The profits are, however, subject to corporate income tax as reported on the LLC’s 1120 corporate tax return. Furthermore, if the corporate profits are distributed to LLC owners in the form of dividends, the dividends are taxed again at the 15% qualifying dividend rate. A LLC treated as a C corporation would pay payroll taxes on any wages paid to LLC members working in the business.

If an LLC makes an election to be treated as an S corporation, the LLC’s profits are subject neither to self-employment taxes nor to corporate income tax. The S corporation does need to file an 1120S tax return, however, and through this tax return the LLC’s owners get taxed on their respective shares of the corporation’s profit. IF an LLC owner works in the business, the LLC-treated-as-an-S corporation must pay a reasonable wage to the LLC owner. The LLC absolutely does owe payroll taxes on these wages.

Also if the members are going to work for the LLC, I highly suggest employment contracts, and buy-out agreements.

And if they are a C Corp, watch out for Personal Service Corporation rules.

As you can see, there is a lot more involved with corporations & tax implications. 🙂

I like this one; good tips and advice.

QUESTION: What if the LLC is taxed as a corporation? Meaning they filed the form 8823 electing to be taxed as a corportation. Then do they do a members draw of does that then get applied to regular payroll and withhold taxes?

Thanks Michelle. What an extremely useful tip. I am so glad I have subscribed to your “Long For Success” QuickBooks Tips.

Diane Offutt, EA, MAcc

Accounting Connections, LLC

Woodstock, Georgia 30189

Thanks Michelle. I was trying to see if there was a way to do this through Time Sheet Entry, but without setting up a payroll item, it doesn’t show up on Unbilled Job Cost reports, nor does it appear as a cost item in the Job Profitability report. I will be passing this along to my contractor/service based clients. Thanks again.

Thanks Michelle. I definately will pass along as needed.

Very interested article. Thank you.

Excellent tip…keep them coming! Thanks, Michelle.

Excellent topic. It amazes me how many new business owners that are sole proprioters that don’t understand this principle. They usually are so used to working for others and receiveing regular paychecks and being a W-2 employee they don’t comprehend what being self employed really means and how it affects their bookkeeping. I recently answered a question to a new business owner of a tax firm that wanted to know if she would get a W-2 or 1099 from her business. She is a sole proprioter with no employees. I suggested she needs to do some research on how to run her business from the bookkeeping side and/or hire someone to do her books or teach her.

Thanks for shaing this great info. I have a number of contractors that this is very useful for.

This is an excellent topic to blog about. I have received this request several times and was not sure how to properly show this. Thanks!