There is a new feature in QuickBooks 2011 that many people have overlooked so far. In QuickBooks 2010 and prior years, if you wanted to post something to Cost of Goods Sold and mark it as billable to the customer or client, you had to use a two-sided item.

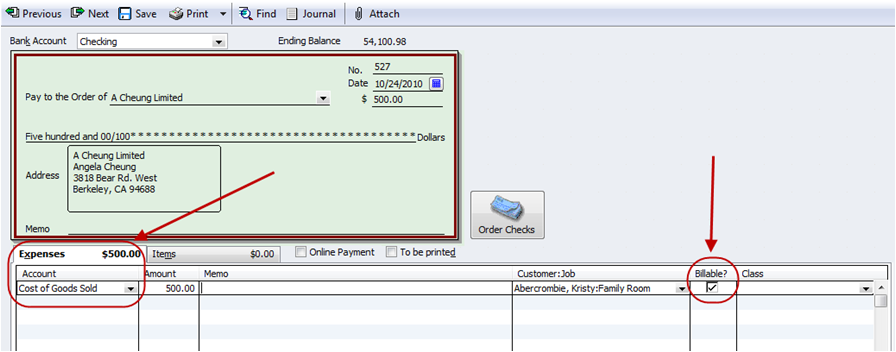

New in QuickBooks 2011 is the ability to enter a payment posted to the Cost of Goods Sold Account (on the Expenses tab), select the customer:job and mark it as billable as shown below.

Although this isn’t a big change, it will be appreciated by many QuickBooks users and Certified ProAdvisors too!

You’re welcome — I’m glad it helped.

Great blog post – helped me re-think how I was setting up merchandise for resale in my own non-profit. thank you for posting.

There are different ways to account for reimbursable expenses. Here’s a blog post with more info: http://www.jenniferthieme.com/reimbursable-expenses.html Also, if you google it, you’ll find several other QuickBooks support articles too.

That makes sense, thank you.

She is a photographer, and pays out assistants (100%, no markup) and has travel, meals and gear purchases that are 100% reimbursable.

The assistant fees that are set up as a ‘service’ item should be associated with what income account? Reimbursed income: other income? How does that play out in her financials so it shows up as non-taxable income?

It sounds like the ‘travel and gear fees’ should be set up as a non-inventory 2-sided item, correct? Can you give me an example of the expense / income accounts to use?

As to which account to use (COGS or an expense), it doesn’t make a difference on the bottom line (net income). Technically, direct costs should be in COGS and that helps with monitoring the Gross Profit. However, if it is posted as an expense instead, that is usually ok too.

Another consideration — you may want to set up 2 sided items so you can get item profitability.

Hi Michelle, always love reading your comments as well. This is a little bit of an old thread, but relevant to a client.

She is starting her company clean with the new QB version 2014 (for all of 2013 – brand new file). She has entered all her expenses / COG and is now going back and entering the invoices.

In trying to enter her COG as ‘billable’, we are finding that isn’t an option (the checkbox won’t appear) but it does appear if we mark the COG as an expense instead.

Q: what is the rule of thumb with a billable item? If 100% of the item is billed back to the customer, should it be entered as a COG or an expense?

@Lynn — you can use an item that is relevant to you / your business. You could set an item up for reimbursable expenses, travel, filing fees, etc. or whatever works for you.

If I enter a bill and note it billable, how what ‘item’ should I use and how do I Invoice it out. Example: Received an expense to pay that will be billed out to a client for reimbursement.

You’re correct — you mark it billable when you want to include it on an invoice to the customer. If it is a fixed fee job, you would not mark it as billable.

Thanks Michelle, always great comments. It sounds like using the Billable check box is only needed if you are going to bill a specific item to a client. In the event where you have labor and materials on a job and you are going to charge the client a price to do construction would you really want to check the box on these invoices to “bill back?” Thanks

You can’t make it reimbursable if you pay the sub after you invoice the client.

Follow the flow on the home page — invoice, receive payment and then make Deposit.

In QuickBooks, go to Help > Learning Center Tutorials for videos to help you learn more about using QuickBooks.

I have a computer consulting and repair buisiness.

I get different Independent Contractors (IC) to teach classes for my customers.

Here is what I have setup so far:

I have an Income account called Training

I have a Cost of Goods Sold account called Subcontractor Training

I have a Service Item called Subcontractor Training

The Subcontractor Training Service Item is mapped to the Training income account for Income Account

The Subcontractor Training Service Item is mapped to the Subcontractor Training Cost of Goods Sold account for Expense Account

I currently invoice my clients individually (creating a new invoice for each one…. wish I could invoice them all at once)

For the service provided, I select the Subcontractor Training Service Item

I Receive and Record Deposits from my customers

At this point I turn around and Write Checks to pay the contractor for his/her service

I select the Contractor (From my Vendor list)

I click the Item down arrow, and select Subcontractor Training Service item.

My question is:

1. Is this the correct way of charging my customers and paying my subcontractors?

2. Being that I get paid by my customers weeks before paying my subcontractors, how do I make the service provided by my subcontractor a billable expense for the invoices of the customers?

If you use the expenses tab, in the older years of QuickBooks you couldn’t post it to Cost of Goods Sold and mark it as billable. Also, when you look at the Job Profitability Detail report it would show up as ‘No Item’. Using Items allows you to see the profitability per item and make it billable in the older versions.

Hi Michelle,

Thanks for the useful tip.

However, what is the different between using the “Expenses” tab and the “Item” tab if I want to post something to the COGS?

It is in the Windows version of QuickBooks? I’m not sure about the Mac version.

When you say QuickBooks 2011, are you referring to the PC, MAC, or both versions?

Hi, Michele

Well, I just did…. That tab is an important one for someone.

Thanks Nancy! I was glad I could ‘scoop’ some of you experts! I haven’t seen anyone mention it in the blog or webinar yet! 🙂

WOW, I didn’t even see that one, I always work with the Items tab for job costing. Good catch 🙂