Many times I hear QuickBooks users say the beginning balance in the bank reconciliation window is wrong and they do not know how to fix it. If a transaction has been voided, deleted and re-entered or otherwise un-reconciled, it will affect the beginning balance in the reconciliation window. You should never just mark transactions as cleared in the register, since they will still show in the reconciliation window. To clear and reconcile them and fix the beginning balance in the reconciliation window (and re set the date if needed), it is necessary to reconcile the account again.

For example, if payroll taxes (or Sales Taxes) were paid with a regular check instead of via the Pay Liabilities window, it is necessary to delete the check and replace it with a Tax Payment. If the check was previously cleared, this will change the beginning balance in the reconciliation window. Thus, it is necessary to reconcile again and mark the corrcted tax payment as cleared.

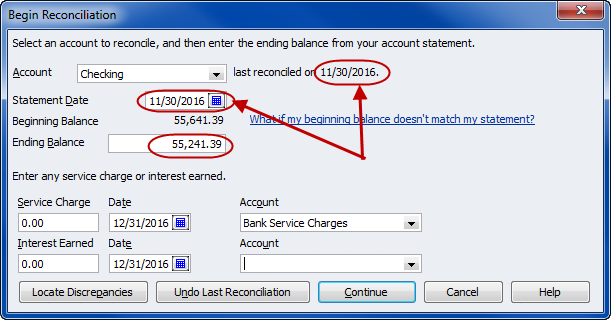

Enter the last statement ending date (or one day different to preserve the original reconciliation report) and ending balance (but not any service charge or interest), reconcile the account again marking the changed transactions as cleared. The difference should be zero. This will fix the beginning balance and reconciliation date.

I sent a payment to our credit card company for the 3 credit cards we have. They only posted payments on 2 credit cards which amount to the check I sent for payment. How do I reconcile the credit cards when the credit card company posted the wrong amount for 2 credit cards and no payment posted on the 3rd credit card?

I deleted some cleared transactions from 2013 and some from 2014 now my beginning balance is off by $100. I have tried to go back and add them but i cant seem to find the $100 difference. My boss says I have to go back and reconcile every month from the date of the first transaction I deleted.

My Quickbooks credit card beginning balance is not correct/does not match, because I am missing a credit card statement, how do I reconcile this credit card account for the missing month’s information and move on to the next month?

My boss handed me their credit card statement and said reconcile this. Every time I do this- it’s never the same and so I never learn what I’m doing. I don’t understand if I’m supposed to take of last week’s charges- I am on limited view being just an admin so I can’t even really SEE anything or last week’s reconciliation to try to copy. Please help. Am I supposed to take this statement and enter everything into the register or what?

You can download transactions from the bank that the credit card is with then when the statement comes click off everything on the statement. If you enter the interest expense in the main window then once everything is clicked it should total 0 then select reconciled.

I am using the latest QBO (and not very proficient yet) and cannot seem to locate what is causing my beginning balance to be incorrect. I have undone all but the last reconciliation without success. What steps would you recommend?

I recently took over the bookkeeper position at a new company. The person in this position previously did manual bank reconciliations. The amounts on her reconciliations do match the checking account balance in QuickBooks, but when I go in and try to reconcile the bank account in QuickBooks, the beginning balance is off. I know the current balance of the bank account is correct, so I don’t want to make any entries to adjust the beginning balance in the reconciliation screen; I simply want to be able to reconcile the account using QuickBooks going forward. How could I adjust for this?

Hi. I have a huge issue. I recently switched my Quickbooks over from MAC to PC. When I did that and went to reconcile my account I was having some issues. So, I marked the box that said uncheck or undo reconciliation. The problem is that it unchecked all the past ones, for the past 14 years! What am I suppose to do now? It would not allow for me to undo it. Now, it shows that nothing has been reconciled in my Quickbooks. 🙁 Please help!

Re-reconcile as 1 big reconciliation. Mark everything as cleared and then uncheck the outstanding checks & deposits.

How does that help me though? I don’t have a starting balance anymore.

Hi! I just started with a company that has been using quickbooks since 1999, they are now using 2012 version. The company has never reconciled their credit card…only input general ledger payments since that reflects banking account. Company now want me to reconcile just previous year for audit purposes. I can not go back and adjust opening balance, is there any other way???

Quickbooks Pro 2010, the bank reconciliations have been done manually for all of 2013 and up to this past month in 2014, The books have been fiscally brought up to date and properly closed for 2012 and 2013 by the accounting professional, however the Quickbooks reconciliation has not been touched since Sep 30, 2012, and the balances were all adjusted to bring the books into proper balance to close out 2012. how to I go back and adjust to the proper starting cash balance as of 10/1/2012 since the books have been all adjusted. Do I make one large discrepency adjustment. Help!

I have a friend who asked me to help clean up their books. However, looks like they have NEVER reconciled any of their accounts since 2011. They have had three different bank accounts one which was closed in 2011 the other in 2012. What happens if we can’t get the past bank statements? It’s kind of a mess..

I am assuming the CPA has already done the taxes for those years so technically you can’t really do anything to change the books for those years. amounts or anything. be careful. if all your trying to do is reconcile I would close out the years in question without reconciling. and begin with this year for final quarter

Hi Michelle

I have the same problem as a couple of people before me that you didn’t help.

I had to change a customer account name and move all invoices and payments into the new name. After deleting the deposits and re recording them my beginning balance is off around 10,000.- I followed your blog and when I enter the last reconciliation date It only shows entries for the past 30 days. A couple of the deposits I deleted go back a year. How can I mark them as cleared when I can’t see them?

After completing the previous months reconciliation with a correct ending balance. The next months reconciliation beginning balance changes when reconciling a few checks. I am baffled. Why is this and what is the fix.

I added customer invoices after reconciling all the way back to feb now customer balances are wrong because of it and my bank rec are wrong for the months i have added back to because i deleted deposits and added them as payments. First time set up catch up messed this up not sure how to fix either. Thinking of starting over geeezzzz

Hi Michelle

My bank register reflects transactions excluding VAT. How can I change it to reflect amounts including VAT?

I run quickbooks for two companies and the second company reflects amounts including VAT. I can’t see why there is a difference between the two companies as I’m sure I set them up the same?

Thank you.

Recently I took over an account for our office, I found 4 invoices that were not processed correctly, so there were double entries, and they were old, I deteled the ones that went directly into the deposit and went into the payment process then deposit, now my begining balance is off by the amounts deleted, although the entries are now correct, can I override the begining balance and go forth?

@eleni — you can adjust the beginning balance in the bank rec window as explained in the blog post.

What blog post. The one at the top of the page? I’m off because I uncleared a transaction from May, 2016.

Was the transaction reconciled and you ‘unmarked’ it in the register? If so, then mark it with an R for reconciled again.

Michelle – I know you’ve answered this before but I’m just not getting it! My entire 2012 reconciled just fine up till December. I go to try to reconcile December & the “beginning balance” (which was once correct) is now off! When I click on “locate discrepencies” it pulls all the way back to 4/13/12 – when I look at it it come up as: reconciled amount $680.00; type of change-cannot determine; effect of change: cannot determine -680.00. I cannot find where or if I made any changes. I see that amount in three places = 1st-in the first bank account that it was transferred froml then 2nd-in the bank account that it was transferred to; then 3rd-the check that it paid out with. I cannot go on to reconcile from December on because I cannot find this!!!! HELP!!!

Denise — if you want to schedule a remote session for me to help you find and fix it, send me an email.

So We are on January 2013 and I deleted a transaction it took place in June 2012 which was already reconciled, therefore it was entered incorrectly. Now I re-entered that transaction but my reconciliation is still off by the amount. I don’t want have to undo all the reconciliation months all the way till June of last year, so is there a away that I can go back and just include that transaction back in that one month?

After you’ve re-entered the transaction, you need to reconcile to mark that transaction as cleared as explained in the blog post.

I am having the same problem with a deleted deposit from 12/11/2014. It shows up on the register and I marked it as cleared/reconciled as per our accountant, but the beginning balance is still off by the amount of the deposit. Our accountant said not to undo anything as she’s already done the 2014 taxes. I looked at your blog, but have never used a blog before and am not sure how to find this explanation.

Follow the steps / details explained in this blog post to re-set / fix the beginning balance in your bank rec window.

The previous office manager before me Reconciled the August statement but never actually closed it out. Not knowing that I started the following months. I cant figure out how to fix this and its messing everything up.

I don’t understand exactly what happened in your situation. You can undo the previous reconciliation (multiple times if needed) and re-reconcile.

I am doing bookkeeping for a small family owned business. No bank statements or invoices were entered in 2011. I have since updated the numbers for 2011 so that I can enter 2012 information but the bank reconciliation has the wrong beginning balance. How do I “adjust” so that I can have my beginning balance match my 2012 bank statement and not have 12/31/2010 number in there? Thanks

I’m not sure all of the details of what has been done so backup the file first. To adjust the beginning balance, you may need to enter a JE.

I am very concerned because I make all deposits for our small business but a woman with a degree in accounting who had my job previously, and does the heavy bookeeping, is saying deposits are missing when I know for a fact I have made them. She comes in and looks the hero after re-entering the checks (without check numbers) and we then have more money and I am left to wonder if she has deleted them from her home. My boss gave her a laptop to reconcile balances at home. How can I be certain if indeed my hard work is being erased and protect myself from this in the future, My job and reputation are on the line as this is my families business. I am going to print copies of all deposits from now on as I relly believe something is up. it has happened several times in the last 5 years.

In Reports > Accountant & Taxes > Voided & Deleted Transactions. Someone other than her should be looking at the bank statements and activity as well.

I just caught up onbank recs for several months and now it says last reconciled 01/13. Can anyone tell me how to fix this? I can’t fix the date in the modify window.

Reconcile again by entering the appropriate date and the same ending balance. You won’t check off anything as clearing. You’re just re-setting the date — similar to fixing the balance as described in the blog post.

Thanks for your help … I noticed that my balance was off after I deleted a couple of deposits to correct payment that were applied wrong. Even though one of the deposits I deleted was 2 months prior, I just cleared it again and in the end my ending balanced matched my statement. Thanks for your expert advice.

Vince

My balance is off back to 12/31/10. That was when the balance was correct last. I reconcile almost daily. I had reconciled up to 4/23/12 when some corrections were made to old items. I unreconciled back to 12/1/11. It was farther back than this. I noticed that the previous reconciliations only went as far back as 10/13/11. I need to unreconcile to 1/1/11. How can I do this if I can’t find the older recons? Should I not have unreconcile all of these and how can I get it back if not? HELP!

Corey

It wasn’t necessary to undo all the bank recs — you could have fixed it as explained in the blog post. At this point, backup the file. Then, do one big bank rec, select only show transactions before the statement ending date, select all to mark everything as cleared and uncheck outstanding items.

When I see a discrepancy in the beginning balance, first find out the difference. I click Modify button at the bottom right. Go to locate discrepancies and see what transaction (s) were deleted or voided. Then correct it in QuickBooks

That’s a good process Rhonda. However, sometimes you need to do more depending on the situation. If a transaction that was previously cleared has been re-entered (i.e. it is no longer marked as cleared), then the beginning balance is off & you need to re-reconcile to clear it again.

The best clients to have are the one’s who are starting out! Nothing is more gratifying than to be able to set up the bank account from day one with the original opening deposit as the beginning balance.!

I suppose it doesn’t take much to please an old bookkeeper!

Good article Michelle. I will share on my facebook page.

Diane Offutt, EA, MAcc

Accounting Connections, LLC

Woodstock, GA 30189