I’m thrilled to share the initial results of Intuit’s Billing Rate Survey again this year. The survey included questions about billing rates, billing practices and more. The survey respondents were a variety of accounting professionals (i.e. bookkeepers, accountants, tax professionals, etc.) with various levels of education, experience and expertise. Keep this in mind and use the survey results to provide some insight and information for your consideration when establishing your own billing practices and rates.

Keep in mind, this article has the initial survey results. Watch for upcoming articles with more detailed breakdowns, billing practices and more. Plus, for a white paper you can download with all the results, make sure you are subscribed to this blog.

Possible Action Items

As I reviewed the survey results, I noticed a few things which many accounting professionals may want to include as possible action items for themselves or their firm.

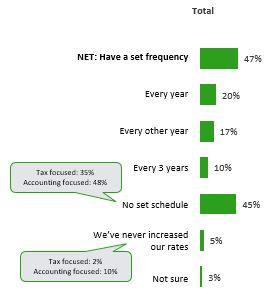

1. Increase your billing rates. Only 20% of survey respondents reported increasing their rates every year and 45% have no set schedule for increasing rates. Assuming you are working, then every year you have more experience and expertise. Plus, many of us have continuing education, obtain or renew certifications, attend webinars or conferences and more. Thus, each year we are more valuable and our rates should increase to reflect your additional experience, education and expertise. Besides, don’t you deserve an annual raise? If you increase the rates a little every year, then you avoid large increases or rates that are too low. If you haven’t increased your rates in awhile, now is the time to do it. You may lose a few price sensitive clients, but they probably are not great clients anyway and usually wind up leaving when they find someone cheaper anyway. Focus on clients who value the services you provide and are ‘A or B’ level clients.

2. Allow clients to pay online (only 42% currently per the survey results) and/or set up recurring charges to automatically charge monthly and/or payroll clients (only 39%). A large percentage (79%) are emailing invoices to clients, however many of us need to take the next step with online payments and/or recurring charges. I use (and love) QuickBooks Payments which allows clients to pay online via credit card or ACH bank transfer (which is now free!). Plus, the payment is automatically recorded in QuickBooks, applied to the invoice and the credit card fee is recorded as well. This is a huge time saver for me and often clients want help to implement it for their business too. (Note billing practices will be covered in more detail in an upcoming article.)

Respondents to the Survey

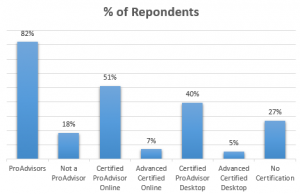

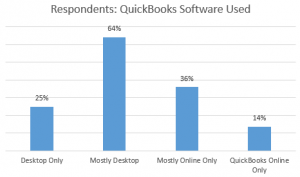

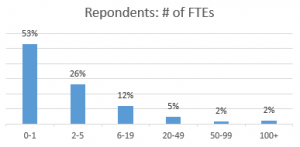

Most the responses were from ProAdvisors (82%), QuickBooks Desktop users (64%) and were solopreneurs or had 1 Full Time Equivalent person working with them (53%). Below are charts with the details on the survey respondents.

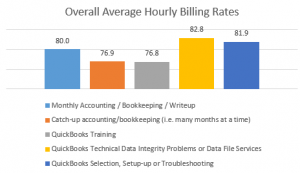

Average Hourly Rates

Advanced Certified ProAdvisors report the highest average rates (with one exception), then Certified ProAdvisor, ProAdvisors and finally non-ProAdvisors. This is what I would expect to see. It clearly shows that members of Intuit’s ProAdvisor Program charge higher rates than non-ProAdvisors. If you are not a ProAdvisor, I would encourage you to join now! There is free membership level which provides access to QuickBooks Online software, training, certification, support and more. You can learn more and sign up here.

Additionally, the survey results demonstrate one of the benefits to getting Certified and Advanced Certified – higher average billing rates. In addition to the self study training (recorded modules and supplemental PDF guides) in the ProAdvisor Portal, Intuit provides numerous free training opportunities to help ProAdvisors get certified – webinars, live in-person training events in numerous cities and virtual conferences too. Plus, most of the training includes free Continuing Professional Education (CPE) credits as well. Details on the free training for certification prep and other topics can be found here. Note — click on an image / chart to enlarge it then back to return to this article.

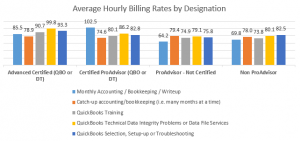

Average Hourly Rates by Designation

As expected, CPAs report the highest average hourly rates (with one exception), then Certified ProAdvisors and finally Certified Bookkeepers. If you are a Certified Bookkeeper, I recommend you join Intuit’s ProAdvisor Program and become a Certified ProAdvisor as mentioned above. Below are the average hourly billing rates by designation and service.

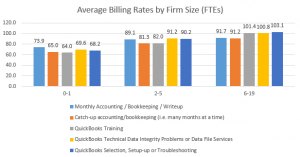

Average Hourly Rates by Firm Size

Again, the results of the average billing rates reported are as expected – the larger firms report higher average billing rates as shown in this chart.

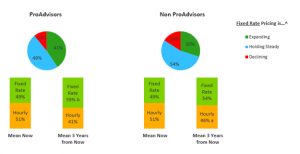

Fixed Fee vs. Hourly Billing Rates

Improvements in technology and automation features in accounting software is allowing accounting professionals to streamline our workflow and operate more efficiently. Thus, many accountants and bookkeepers are switching from hourly billing to a fixed fee or value pricing method. As you can see in the following charts, currently it is almost evenly split between fixed fee vs. hourly billing. However, 34% of accounting professionals expect to increase their fixed fee billing in the next 3 years and it is higher among Certified ProAdvisors. This is what I expected based on the accounting professionals I talk with across the US and in various social media forums.

What are your thoughts about the initial survey results? Did anything surprise you? Did you discover you need to increase your rates? Leave your comments as a reply below.

Watch for other articles with more details and discussions of the results of the average billing rate survey – including details about billing practices, discounts and more.

Stay subscribed for future articles and a white paper with all the results for you to download. Here is a subsequent article with results on billing methods, procedures and write-offs.

Note: This article originally appeared on Intuit’s Firm of the Future website.

What part does education play in these prices. I have a MAcc and a JD.

Experience working with lawyers since 2003 – in house.

The more education and experience you have, the higher rates / prices you should command. But, the education & experience should be relevant to the work and services you’re providing.

$80 average per hour for monthly bookkeeping? that’s just wishful thinking.

No it isn’t — these are actually bookkeepers and accountants who replied to the survey. Many people are not only charging $80 per hour, but many are charging more since that is the average. You can increase your billing rates with more experience, specializing & becoming an expert, certifications, etc. Also, you should be increasing your rates every year.

And remember — don’t underestimate the value of the services you provide!