How do your billing policies and procedures compare with other accountants and bookkeepers? Should you implement changes to help improve your firm’s efficiency and operations? Let’s examine more results from Intuit’s Billing Rate Survey.

Billing Methods by Service

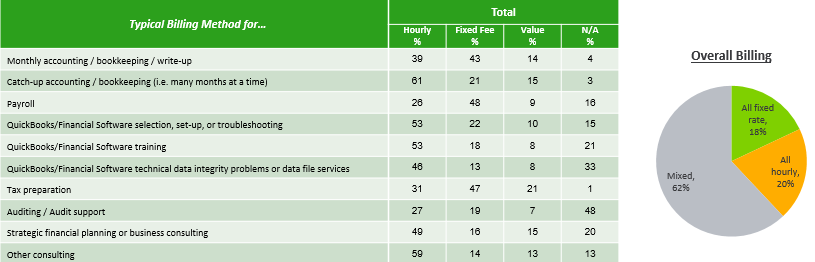

As noted in the previous article with the initial survey results, “34% of accounting professionals expect to increase their fixed fee billing in the next 3 years and it is higher among Certified ProAdvisors.” In looking at the details of billing methods for various services, there are a few things to note:

- Fixed fee and value pricing is more common for monthly accounting/bookkeeping/write-up work (57%), payroll (57%) and tax preparation (68%).

- For catch-up accounting/bookkeeping (i.e. many months at a time), 61% use hourly billing. However, I think fixed fee or value pricing should be used instead of hourly billing for catch-up work. When using QuickBooks Online it is easy to import bank and credit card activity (via a .qbo, .qfx, .ofx or .csv file), set up bank rules and process a year or more of transactions in a fraction of the time previously required. Check with the bank or credit card company to download transactions older than 90 days. If you can only get PDF bank statements, there are tools available to convert the PDF into a file which can be imported into QuickBooks. (Check out the QB Power Hour archives for recordings on this topic.) With this ability to get many months of transactions processed in a fraction of the time, hourly billing just doesn’t make sense (unless you want to make less money).

Billing Policies and Procedures

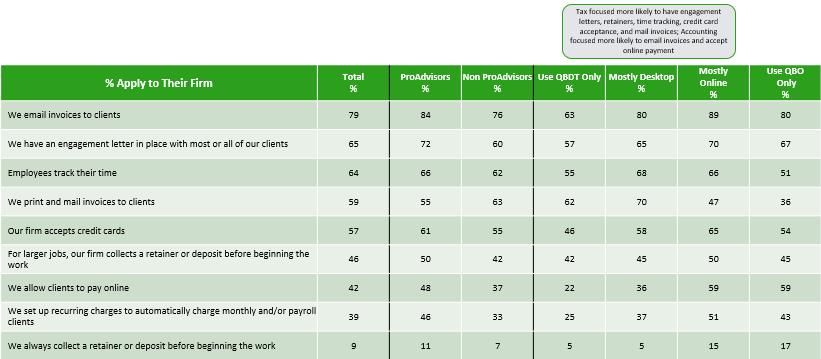

It’s interesting to see the billing policies and procedures of accounting professionals and to compare the results for different groups. For example, ProAdvisors and those with more of a focus on QuickBooks Online are more likely to:

- email invoices

- accept credit cards

- allow clients to pay online

- set up recurring charges

- collect a retainer or deposit

- use an engagement letter

ProAdvisors and firms with an online focus are implementing technology and automation features in their firms’ billing practices. QuickBooks Online makes it easy to automate recurring sales receipts or invoices (which can be automatically emailed too) for monthly accounting and/or payroll services. The recurring transactions in QuickBooks Online are truly automatic – there is no need to login or do anything.

Then, with QuickBooks Payments, clients can pay online and it is automatically recorded in QuickBooks (along with any credit card fees associated with the payment). Or better yet, set up recurring Sales Receipts to automatically process the payment from the client’s bank or credit card (with their permission and signed authorization form). This is a great opportunity for savvy accountants to save valuable time by automating your billing and collection procedures.

Additionally, it is interesting to note that only 51% of the QuickBooks Online only users report that their employees track their time (64% total). As more accountants implement fixed fee or value pricing, many are no longer tracking their time. With the automation and time saving features of QuickBooks Online and other technology, hourly billing often doesn’t make sense anymore.

Reducing Fees (Write offs)

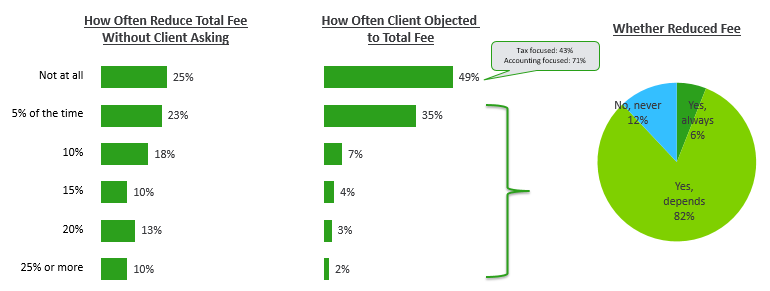

This area of the survey results revealed some startling results for me – 75% reported that they have reduced the total fee without the client asking! How often does an attorney, plumber, electrician, or any other service provider charge you less without you saying anything about it?

As accounting professionals, we need to realize the value of the services we provide. While it may be ‘easy’ for us, it isn’t for our clients! You probably have years of education, training and experience which is valuable! We shouldn’t undermine our own prices!

Another interesting result – 51% reported that a client has objected to the total fee. I would surmise this occurs when the accounting professionals is using hourly billing. Switching to fixed fee or value pricing should reduce client objections since they would know the total price before the work begins (or at least a price range). Plus, most of the accounting professionals (82%) subsequently reduce the fee when the client objects. Reducing fees isn’t a good practice and most of us would probably like to avoid it. We should strive to do a better job communicating with clients about the fees upfront. Using an engagement letter would help clarify the services provided and associated fee. As shown in the chart above, only 65% reported using an engagement letter with most or all of their clients.

Did you identify opportunities for changes to your firm’s billing methods, policies or procedures? Have you automated your billing process yet? Now is a great time to start implementing changes to your billing. If you want to continue learning more about QuickBooks, join the ProAdvisor Program (for accountants and bookkeepers working with multiple clients – it is free for QuickBooks Online training, support and certification) and join me for QB Power Hour webinars (free).

NOTE: This was originally posted on Intuit’s Firm of the Future website.

A great informative post you shared on this page about billing method process help for your business, I read this post and remember the best points especially ” The Taxman Is Calling ” you shared in this article which help me for running a business successfully with the help of professional accounting .If you want to start a business successfully then you must read this article carefully and keep it in your mind all the best points of a great article which help you to submitting a bill of business tax successfully with the professional accountant .

Thanks