Often, I see the question “how do I create a monthly Profit & Loss Statement in QuickBooks”. I thought I’d write a quick post to show you how to do it. You can use this same method on the Balance Sheet if you would like to see it monthly. 1. Create the Standard Profit & Loss report (Reports > Company & Financial > Profit & Loss Standard).

2. Change the dates to the year desired (for a calendar year from January 1 to December 31 for the year desired)

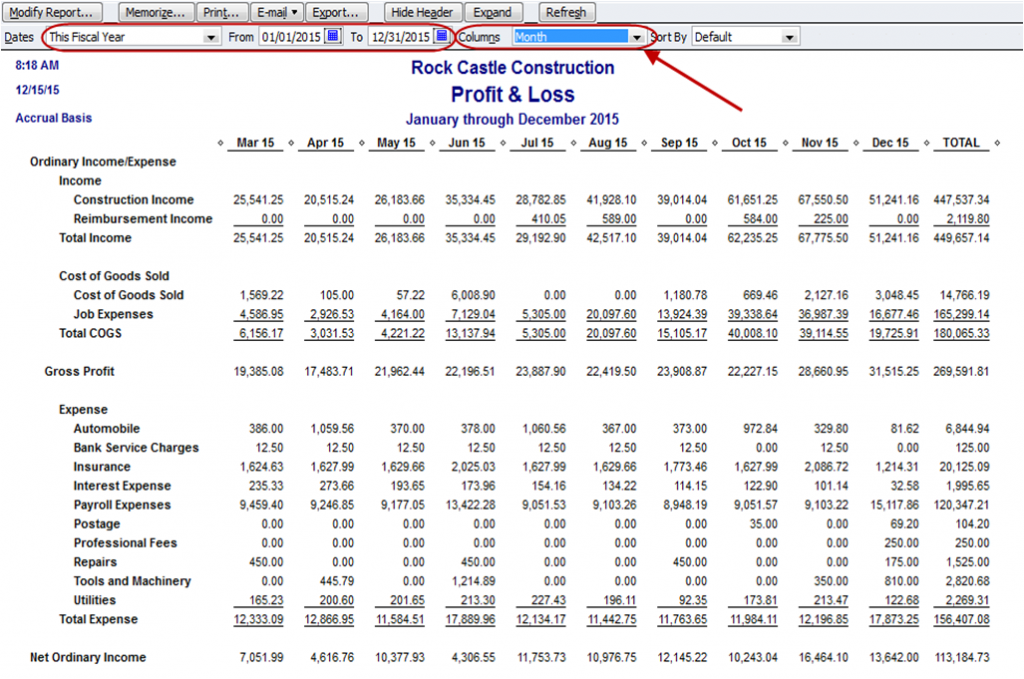

3. Change the Columns to Display to Month (as indicated by the arrow below)

4. Optionally, click Collapse to see just the main accounts and one column for each month

Your report will look like this: You could memorize this report if desired. Also, you could use this report to create charts or graphs with the trend in monthly sales or net income. If you use Intuit Statement Writer, you could create a template with the monthly Profit & Loss and charts and graphs which would be linked to the QuickBooks data. This allows you to reuse the template in future periods or with other clients. You may want to read about What’s New for Intuit Statement Writer 2011 to learn more about it and how it could help your practice.

You could memorize this report if desired. Also, you could use this report to create charts or graphs with the trend in monthly sales or net income. If you use Intuit Statement Writer, you could create a template with the monthly Profit & Loss and charts and graphs which would be linked to the QuickBooks data. This allows you to reuse the template in future periods or with other clients. You may want to read about What’s New for Intuit Statement Writer 2011 to learn more about it and how it could help your practice.

Is there a way to do a monthly report by class? Specifically, I want to each month and under that each class for that month. I have 2 different classes and I want to tack them each by month in a trend report. So at the end of the year, I would be able to see all 12 months with 2 classes detailed under each. A total of 24 columns.

Is there a way to create a monthly Profit & Loss by Job for ONLY jobs that were billed that month?

Create the P&L on an accrual basis for the month desired — that should get close to what you want.

Great. It is so easy. You have alleviated my frustration.

Michelle, thank you for sharing in formation.

THANK YOU SO MUCH FROM A TIRED NON-ACCOUNTING PROFESSIONAL. AND YES! I”M YELLING!! 🙂

Is there a way to do a monthly report by class? Specifically, I want to each month and under that each class for that month. I have 2 different classes and I want to tack them each by month in a trend report. So at the end of the year, I would be able to see all 12 months with 2 classes detailed under each. A total of 24 columns.

How can I make a report that only shows my fixed monthly bills?

It depends on how things are set up — you could create a report of just those accounts or a report of memorized transactions, etc.

Can you add discounts to this PL report. I have saved % disconts under pay bills vendors. However now the discounds do not show up under my PL like they used to when I would break down the expenses in pay bills.

Thanks Michelle,

Often times we tend to concentrate on what we already know and we end up not exploiting QBs full potential.Tips like this will further quicken the financial reporting exercise as well as enlightening the users of how Quickbooks can be user friendly.

Just saved me hours of work. Can’t thank you enough! I’ll be back for more tips at budget time!

Thanks Michelle! I enjoy learning new applications.

This monthly P/L report tip is great Michelle! Yesterday, a client asked for something exactly like this and I remembered reading this last week and I pulled it out for him and he was so excited! Thanks!

Thanks everyone! I’m glad it is helpful!

@Bill — I wonder the same thing!

As a CPA and running a business you are greatly appreciated for your contributions to LIve Community and the additional assistance you provide with your blogs. Thank you for sharing.

This was extremely helpful, thank you for sharing this best practice!

Posts like this about monthly reports are always interesting because of their possible inference that business owners are not creating these reports and not getting all the information available to make them more successful. Which always leads me to the next question…What are they using for information?

I agree – the more we are reminded of even the “simple” things… the more efficient we will become. I totally forgot about expand/collapse and it is really handy. Thanks Michelle.

Michelle, thank you for sharing these great tips. The more information that we learn from one another, the more efficient we become, and ultimately raising the level of service to our clients!

Pingback: Tweets that mention How to create a monthly Profit & Loss report in QuickBooks | Long for Success -- Topsy.com